The Era of Alt Data is Upon Us (Again)

As more and more data is restricted or disappearing we're entering a new era for the use of alternative data in investment decisions, but this time it's likely to be more fragmented.

Yesterday we were hit with the surprising news that one of the most closely followed data points regarding the Chinese economy over the last half year or so, the youth unemployment rate, was no longer going to be published. The data was officially deemed too messy and imprecise to be useful and published, and so investors and the world at large will instead be left guessing as to the state of youth unemployment.

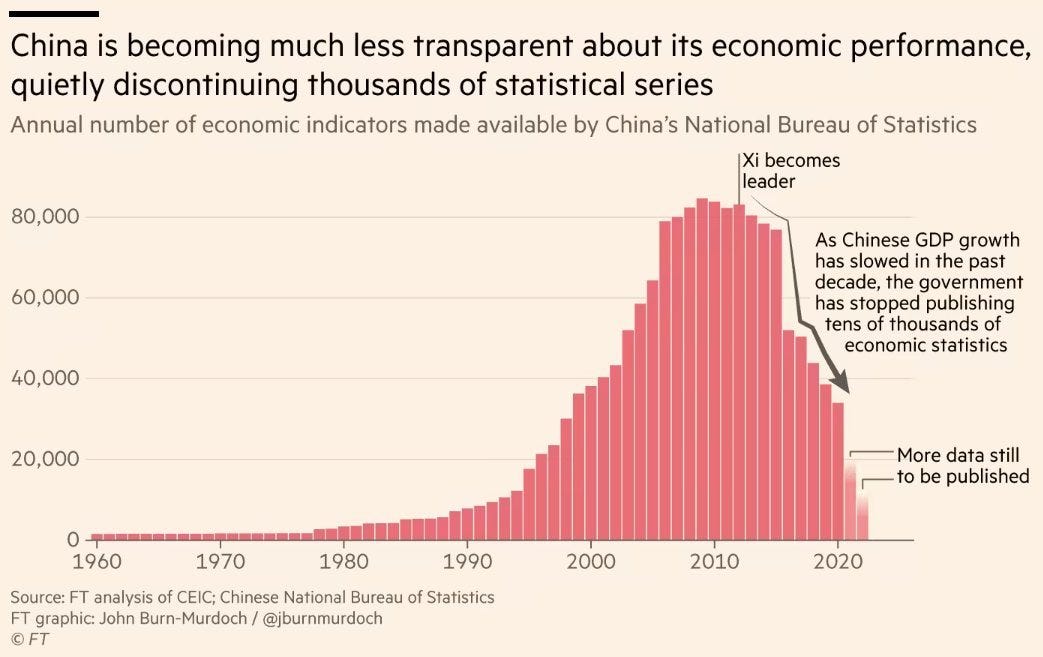

While some reacted with surprise, this is actually part of a wider trend in China over the last few years. John Burn-Murdoch of the FT has a good summary and a handy graph showing the disappearance of official statistics published by China. You should read it if you want the views of someone smarter than me discussing these things. This would be hard to deal with for investors in and of itself, but it’s coupled with other restrictions in the ability to get company information from China, or even conduct due diligence on possible investments.

The issue is of course not just limited to the data not being published, it has a wider impact on the trust investors place on the data that is. If the government starts scrubbing data they don’t like the look of, this also creates the view that any data that is published has to be approved by the government, even if just implicitly. This of course means that many are likely to think that any bad data that is published has already been massaged to look better, otherwise it would also be cut.

The spiral this can set off is quite self-evident, as investors start over interpreting any bad data and the government feels attacked and misunderstood because of this and therefore implements even more curbs. But the information landscape is currently trending in this direction, and there’s not much evidence that we will see a turning point anytime soon.

The need for good information to drive increasingly tough business decisions certainly hasn’t diminished, so what we’re seeing instead is a return to alternative data to interpret the state of the Chinese economy. This can of course cause any number of problems as well, since alternative data sources can only approximate an answer to the actual questions being asked, but at times like this you work with what you have access to.

Long-time investors in China are used to operating in these types of environments anyway, with many using alt data as a sanity check on official data for a long time (see for instance the Li Keqiang index). But this time is perhaps a little bit different, and that can have a meaningful impact on the overall investment landscape.

The really big difference this time is the increased pressure on the banks and traditional sources of research on the Chinese economy. Given the pressure to stay positive - or at least not negative - on the state of the economy, it’s unlikely investors can turn to these sources for good alternative interpretations either.

This means that we’re likely to see a lot more in house research on these topics, or at least we should unless the powers that be decide to completely ignore the risks involved here. And this means we could be seeing increasingly varied views on the state of the Chinese economy, as well as specific industries between different market actors.

As someone who used to work a fair bit on alt data for China I find this very interesting. While it’s not ideal from a market efficiency point of view, it does mean that there should be a lot more opportunities for actual mispricing. This should mean that there are opportunities here for investors with good knowledge of the actual conditions on the ground, and the ability to use better data sets to stay ahead with the overall market view.

It might be a rockier ride than having an underlying 10% GDP growth to float your investment thesis, but it’s also a lot more interesting.

Over the next little while I’ll write some short pieces about alt data sources I come across and find interesting. It won’t be an exhaustive list, and it won’t ever be an endorsement to use any metric, and certainly never only one metric, but I hope it’ll at least be interesting and offer some ideas that can be put into practice.