The Chinese Tech Innovation Sweeping Southeast Asia: VIEs

As tech companies in Southeast Asia seek to emulate the success of their northern counterparts they've started embracing VIEs to help expand in the restrictive regulatory landscape.

At a time when Chinese companies are increasingly facing headwinds as they try to push out internationally, a key innovation from the Chinese tech space is receiving a warmer welcome. The VIE structure is increasingly being adopted in markets outside of China.

Asian markets tend to be characterised by varying levels of protectionism for local players, usually in the form of some level of investment restrictions for non-domestic players. But governments will now have to reconcile with the fact that the Chinese tech space has helped the finance sector solve this problem, and more importantly it has established a precedent that international capital markets are relatively fine with it.

The investment landscape in southeast asia is naturally more fragmented than China’s, but we still find many key markets with investment restrictions that companies might want to work around. Or as SEA Limited (NYSE: SE) puts it:

The Company operates in various markets that have certain restrictions on foreign ownership of local companies. To comply with these foreign ownership restrictions, the Company conducts certain businesses through VIEs using contractual agreements (the “VIE Agreements”).

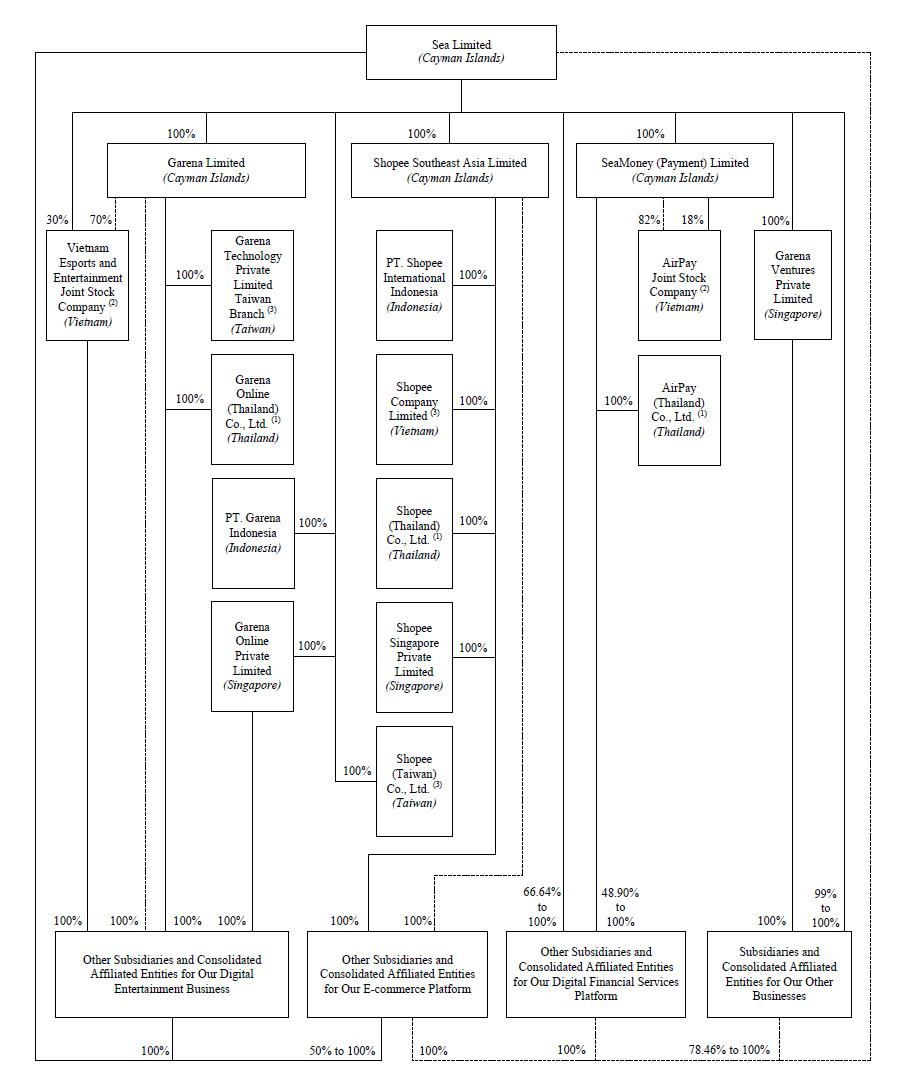

In the latest financial statement they’re largely vague on what these markets are, but we get a better view in last years annual report, so we can at least say where meaningful VIEs were used then.

According to that filing, accompanied by this less than informative org chart, SEA used VIEs primarily in Vietnam, but also previously in Taiwan.

There are some interesting differences here in that the shareholders of the VIEs aren’t laid out in detail, so it’s harder to do a proper risk evaluation of the structure, but since the company files in the US we still get a good breakdown of the financials involved.

They also use a novel ownership structure in Thailand, which looks a lot like a more advanced version of the sino-sino-foreign structure that used to be employed in China pre-VIE. So some variety to spice up the corporate risk assessments.

Lalatech, the company behind Lala Move and Huolala here in China, has also used a VIE structure in a non-Chinese market. We get some details from their recent HK IPO filing.

They of course also have a VIE for their China operations. Seemingly all owned by just one employee, which seems excessively risky when there should be better options around. Old-timers might be reminded of what happened at Gigamedia for instance.

The company has also used a VIE-style arrangement in Indonesia, however, since there are ownership restrictions for their industry. Which means that the company’s biggest market, and one of their key growth markets are now both subject to VIE risk.

What’s more, I haven’t seen much evidence that any of these companies using VIEs internationally are taking many steps to limit their use. That is to say, I’ve seen no structuring of key assets away from the VIEs for the local market, or even attempts to make sure that as much of the business as possible is structured into subsidiaries that the listed company owns through equity.

This last point is actually a requirement under HK listing standards, but I don’t think there will be much movement from the exchange or the regulators on that front.

Overall there’s actually less risk disclosure than I would have imagined, especially since these appear to be international agreements, which will open them up to another level of scrutiny which might be problematic. More on that in a later post.

It is perhaps somewhat poetic that at a time when the Chinese tech sector is still reeling from increased regulatory scrutiny, and an increasingly hostile foreign environment for expanding outward, one of their most successful exports is a financial machination for skirting regulations on foreign ownership. It will also be interesting to see if the widespread adoption of VIEs in China will become a comparative advantage for Chinese companies in some jurisdictions as they’re simply more familiar with how to operate in such an environment.

Still, a big question looms for both companies and investors. China has seemingly been okay with companies skirting their foreign ownership restrictions (their own ones at least), but will other countries also look the other way?