That's Not the VIE You're Looking For

With VIE's in the headlines there is plenty of risk analysis to go around. However, much of it seems to misunderstand some basics of how VIEs work, or sometimes even what a VIE is.

As VIEs have moved back into the headlines and it’s interesting to see a lot of different takes and analysis of the situation. Much of it is focused on the macro questions: Will the government do a wider crackdown on the practice? What industries are most at risk? How are experts analysing the latest statements from the government?

Much of this analysis is very interesting, well-argued, and often provides insightful takes on what might be next steps.

However, much of it also misses the mark when they’re describing how VIEs work, or sometimes even what a VIE is. Part of this is likely just due to space and time restrictions. VIEs are somewhat complex, and above all not easily introduced properly in a short paragraph, which is often what’s required of the writers.

The problem is that these simplifications are taking root and influencing what people think VIEs are; this is true for the general investor at home and for many analysts and fund managers. Thus, it leads to some fundamental errors when evaluating both the overall situation regarding VIEs and the possible impact on individual- or a portfolio of companies.

This is worrying, since it implies that many professional investors who hold major stakes in Chinese companies don’t understand how their investments work. I often say that investing in China without understanding VIE structures is like investing without knowing how equity ownership works. Further, in order to have productive conversations about VIE risk it’s important that at the very least we’re all talking about the same thing.

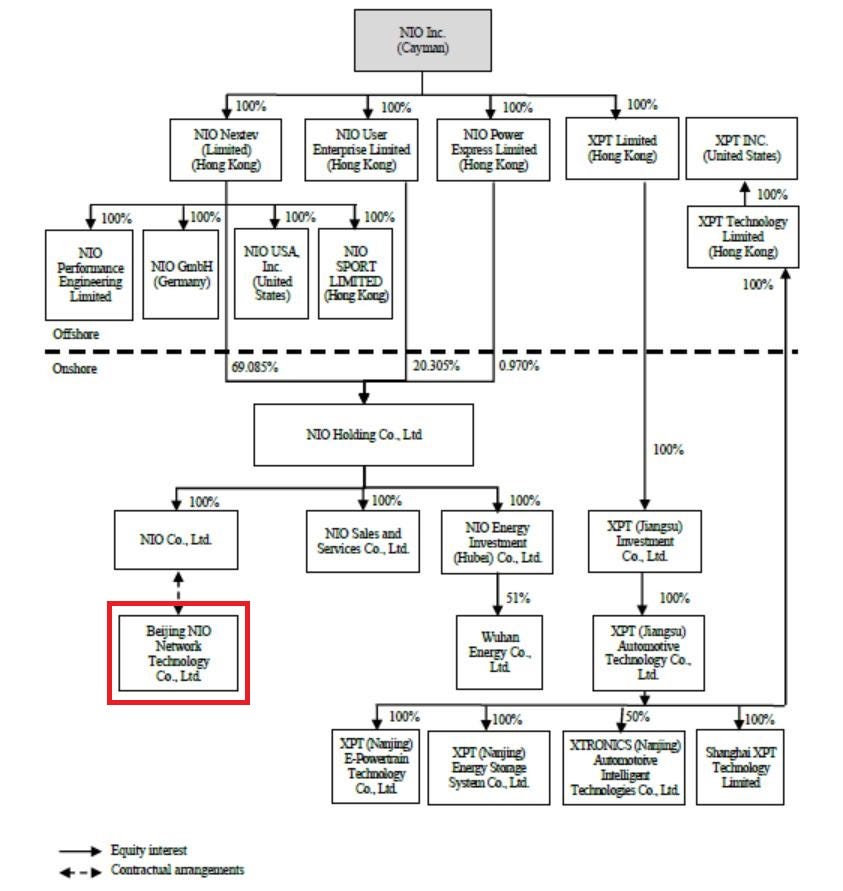

So, to clear up some basics I thought we’d start by pointing to the VIE on an org. chart.

That’s not the VIE

This might seem trite, but not understanding this and some of the misunderstandings that flow from it probably accounts for 85% of the bad VIE analysis I see.

“Chinese VIEs, usually based in tax havens such as the Cayman Islands, are essentially holding companies designed to get around strict rules that forbid foreign investors from any ownership over key sectors, such as tech”

This description or some derivative of it can been seen far too often, and it’s also something I’ve encountered in conversations. However, it gets the entire structure completely backwards, and leads to a whole slew of incorrect analysis based on this base misunderstanding.

The Cayman Holdco is not the VIE. I repeat, the Cayman Holdco is not the VIE.

The VIE is a domestic company in China, which is owned by PRC citizens. It is controlled by a set of contracts that are signed with a Chinese subsidiary of the listed company.

As we can see in this simplified diagram of the archetypal VIE, the Cayman Holdco is set up to hold ownership of the company’s subsidiaries (and to get around some securities and forex regulations regarding listing companies), and the VIE including all the VIE contractual relationships are all onshore in China. This means that as an investor in the Cayman company you still have equity ownership of everything, apart from your VIEs, and there is no contractual relationship or money flows directly from the VIE to the Cayman company.

A Common Misconception

The idea that the VIE is the Cayman company has created some issues when analysing VIE risks. For instance, the often-written sentiment that when you invest in “a Chinese VIE” you actually don’t have any rights to the assets of the company, you’re just buying synthetic exposure to the “real company’s” income.

This analysis makes sense if your view of VIEs is that they are a set of legally questionable contracts, and that they exist between the Chinese opco and the Cayman Holdco (“the listed VIE”). If this was how the relationship was set up then all VIEs really would be the same, and foreign shareholders wouldn’t own any part of the business in China.

However, since the disputed contractual relationship is not with the Cayman company that foreign shareholders invest in, but among the listed company’s subsidiaries in China, what we actually find is that VIEs vary widely both in how they are set up and in how they operate.

Instead of being the uniform risk implied when people say a company “is a VIE”, what we have is a wide range of VIE utilisation and risk profiles. Even within the same industry, VIE use can range from essentially 100% of the China operations, to literally zero.

We can use NIO as a pertinent example here. You may have seen it used to illustrate VIE risk in general, and it’s sometimes presented as a Tesla without any ownership of the underlying assets.

Once again, this analysis makes sense if you think of the Cayman company as the contractual control point, but since we now know that it’s not, we can have a look at the actual VIE usage and see what’s in this part of the business.

We can see from the org chart that currently NIO only discloses one VIE. The company used to have more but it terminated the agreements and thus deconsolidated the entities. In NIO’s case foreign shareholders own and control all of the operations that are outside of this one VIEd entity.

If we move further down the annual filings we can see that the company disclosures say there are no material assets or operations in its VIE, and the same goes for the VIEs that were deconsolidated. These entities are likely set up for planned products that might be in restricted industries, say a ride hailing app or some car-related online platform tech.

So, as far as the current business is concerned, foreign shareholders in NIO own all of the business, which is somewhat different to owning none of it.

As we can see this base misunderstanding can produce a VIE risk assessment that strays pretty far from reality, and incorporating this into your risk modelling and decision making is likely to lead to some pretty sub-optimal decision making.

Other issues that arise from this misconception is confusing issues relating to ADR’s and dual-class voting rights with VIE structure risk, and the idea that all profits are flowing out of the VIE and into the Cayman’s in a giant tax-dodge. In fact, you will find that profits often do not leave the VIE, never mind the country, and there are some potentially severe tax inefficiencies that can come from using VIEs, but that’s too much to cover for now.

There are plenty of issues relating to VIEs, both on a macro and a micro level, and these issues need to be discussed more and understood better by investors. But this is only possible if we’re at least talking about the same thing--and with the current levels of confusion about VIEs, we’re not.