Alibaba’s spinoffs: more clarity, more complexity

Alibaba's new spinoff plan doesn't actually look that new, and is likely to increase the complexity of one of the worlds most complex corporate structures.

Alibaba just floated the idea of reorganising its different business units, setting them all up to act independently, and potentially even listing some of them to take in extra cash and presumably also attaining that wholy grail of all major reorganisations: unlocking value.

The change would is also likely to lessen the chance of potential anti-monopoly issues going forward. So there are a lot of potential positives, but what seems like a certainty is that it will make one of the worlds most complex corporate structures more complex, and with that also comes potential downsides.

On the face of it the news seems quite surprising, but there have been signs along the way that this might be coming. The business areas being put forward were already outlined and organised in the same manner in the company financial statements, and there have been rumours of this type of restructuring to increase autonomy since 2021.

It’s also interesting to note that the current corporate structure is largely in line with what is being proposed here, so it’s quite likely that this is something that has been planned for some time.

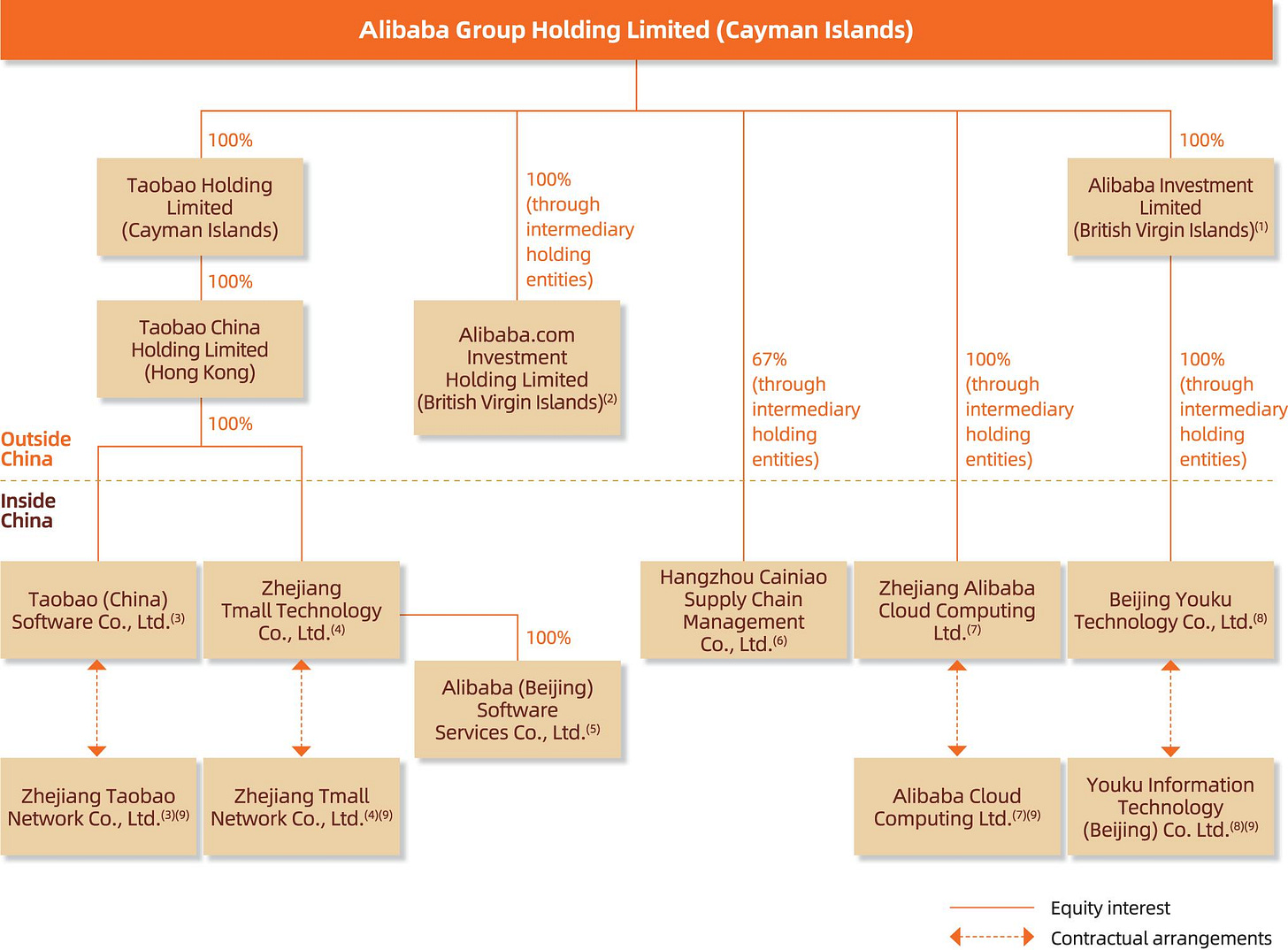

Here’s the heavily simpliefied org chart from the company’s 20-F:

This means that the company should be well placed to act on the plan, and we should hopefully see a relatively smooth transition.

It’s also unlikely that they would have announced the plan now without first getting some informal clearances from the government for any restructuring that would have to take place. I suspect the government would have insisted on it given the scrutiny the company has been put under.

So while we’re likely to see movement on the plan relatively soon, the changes in operations will create more complexity for investors to navigate, as well as potential conflicts of interest and governance issues.

For instance, Alibaba currently discloses that they have basically no revenue or income running through their VIEs, the business that is actively running through a VIE setup is related to the cloud services. It’s never been entirely clear how they’ve set up in order to accomplish this, but given that essentially no other company has been able to keep their VIE utilisation so low in any of their individual businesses means we might expect independently operating units to have to increase their reliance on the VIEd entities.

Speaking of the VIEs, they are currently set up with ownership held by members of the Alibaba Partnership, which will create some detrimental corporate governance realities for new investors in the spinoff companies. Minority rights are already an issue for Alibaba, and it’s likely to be even worse for the spinoff companies.

Finally, while the government has indeed taken golden shares in two of Alibaba’s VIEs, due to how the company has structured their business the influence of these shares on the core business of the company is actually pretty limited. However, if the units will be operating independently it’s possible to government will demand golden shares in each listed unit individually. This coupled with increased VIE utilisation would drastically increase the amount of influence and leverage this golden shares can have over day-to-day operations.

So, we’ll end up with the same corporate structure at the top, but with more minority shareholders in listed subsidiaries with related governance challenges. They would also likely increase the reliance on VIEs and the exposure to government interference via golden shares. The plan makes sense on paper, but it is not a slam dunk for investors.